Cost of Goods Manufactured Formula

Beginning Work in Process Inventory. COGM 135000 150000 35000 150000.

Cost Of Goods Manufactured Template Download Free Excel Template

If the manufacturing cost is high the company needs to plan accordingly to create a budget to make the most out of the annual revenue.

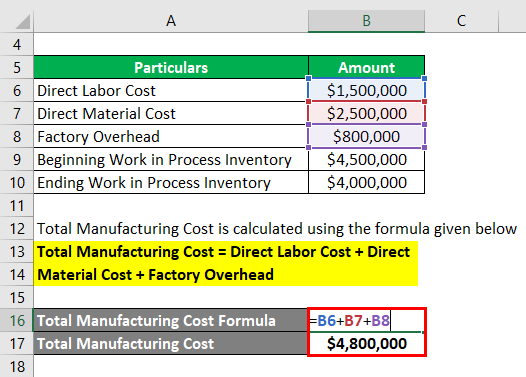

. The calculation is. To make informed decisions and to keep track of your companys profitability. Direct materials direct labor manufacturing overhead total manufacturing cost Use these four steps to compute total manufacturing costs for a product or business.

Calculate the cost of goods manufactured. Lets say your starting inventory is 3481. The costs for manufacturing these parts are.

Understanding your company starts with an understanding of your companys costs. COGM Beginning work in. Otherwise it is the price of the resources of your.

The cost of goods manufactured COGM is an accounting term that refers to a statement showing a companys total production costs within a specific period. For partnerships multiple-member LLCs corporations and S corporations the cost of goods sold is calculated on Form 1125-A. We will use these values in the costs of goods manufactured formula.

The cost of goods manufactured COGM is a calculation that is used to gain a general understanding of whether production costs are too high or low when compared to revenue. COS Opening Stock Purchases Closing Stock COS 50000 500000 20000 COS 530000 Thus from the above example it can be observed that the cost of. Using the cost of goods sold equation you can plug those numbers in as such and discover your cost of goods sold is 33000.

Beginning inventory Cost of goods manufactured - Ending inventory Cost of goods sold This calculation is used for the periodic inventory method. Use the numbers in the formula mentioned above. The cost of goods manufactured is the cost per unit of product manufactured work performed or service rendered.

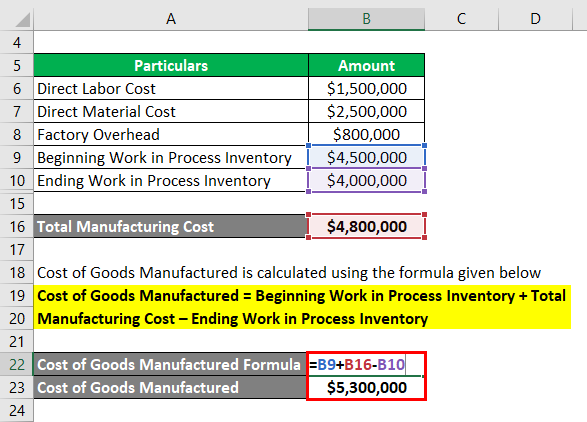

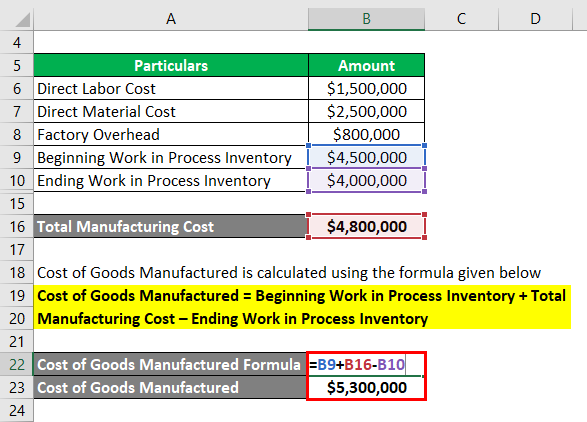

So here is the cost of goods. The following is the formula used to calculate the cost of goods manufactured along with a breakdown of what each piece of the formula means. Accounting for Cost of Goods Sold There are.

First we need to reach the direct labor cost by multiplying what is given Direct Labor Cost 10 100 500 500000 Total.

Cost Of Goods Manufactured Formula Examples With Excel Template

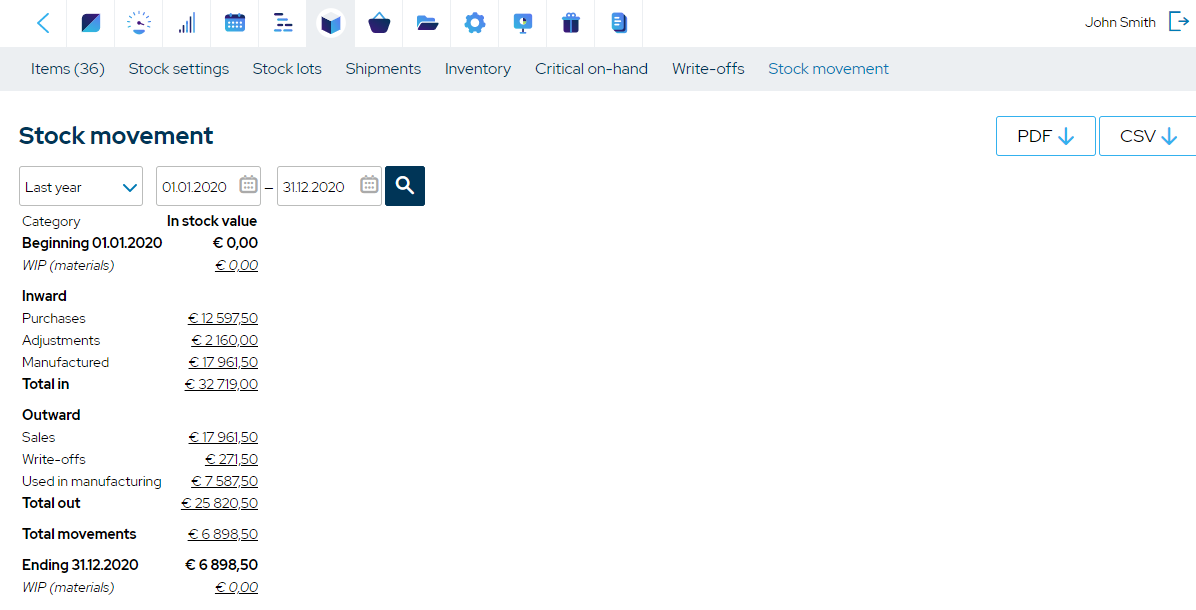

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

No comments for "Cost of Goods Manufactured Formula"

Post a Comment